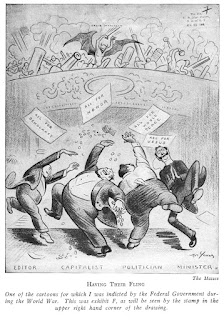

Everybody is under suspicion

But you don't wanna hear about that...

It is to two economists with the American EnterpriseInstitute, Steven Kaplan and Joshua Rauh, that we owe the meme that the Forbes 400 represents the fruits of social mobility, the rewards of an essentially meritocratic society..

But you don't wanna hear about that...

It is to two economists with the American EnterpriseInstitute, Steven Kaplan and Joshua Rauh, that we owe the meme that the Forbes 400 represents the fruits of social mobility, the rewards of an essentially meritocratic society..

Kaplan and Rauh have divided the individual who find places in

the Forbes 400 from 1982 to 2012 into three categories: that that come from

wealthy families, those that come from upper middle class families, and those

that come from working or middle class families. The claim to discern a

distinct change from 1982 to 2012 – the number of individuals coming from

wealthy families declines, while those from upper class families increases.

Thus, there is churn at the top, due to the meritocratic structure of American

capitalism.

Lets go into the ways Kaplan and Rauh are full of hooey.

A.

Granting, for the moment, that the

categorization, although a bit fuzzy, does actually represent three different

kinds of individuals, we have to trust Kaplan and Rauh on their judgments as to

which class individuals fall. They don’t include the list of all individuals on

the list – in Peter Bernstein’s book about the list, All the Money in the

World, there were 1302 people on the list from 1982 to 2006, which makes it likely

that there might have been fifty to one hundred more in the six years after

2006 – but instead give us representative names – which is how we know that

they included Bill Gates in the upper middle class group, because his father

was a well known lawyer. This tells us a lot about the laziness and bias of the

authors. Even a cursory glance at the numerous profiles of Bill Gates over the

years would tell you that he was endowed with a million dollar trust fund by

his maternal grandfather, who owned a Seattle bank. A million dollars back in

the sixties was a figure to reckon with. If one can’t trust the authors about

Gates, one of the five names they mention, how are we to trust them about the

rest?

B.

Of course, family money is a tricky subject.

Carl Icahn definitely came from a middle class family. On the other hand, when

Icahn was 32 and wanted to buy a seat on the NYSE, it was certainly convenient

that he had an uncle, Elliot Schnall, who was a Palm Beach millionaire and who

could loan him the money without questions.

C.

But even granting that there are meritocrats in

the purest sense on the 400, like Jeff Bezos, does this prove Kaplan and Rauh’s

point? By no means. Because we want to know that wealth is churning in response

to meritocratic pressure from below. One of the symptoms of a vigorous churn

would be the fact that few 400 figures remain on the list for long. If they do,

we have evidence of wealth stratifying in a hierarchical way – wealth is just

going to wealth. Go back to Jeff Bezos. He has been on the list since 1999 –

giving him a stretch of 15 years. This is not unusual – as is obvious from

Bernstein’s appendix in 2006. This fact should lead us to a deeper

contextualization about the 400. As almost all economic histories show, between

1932 and 1979, America experienced a great leveling. It wasn’t that the wealthy

went away; however, the labor and white collar wage class enjoyed incredible

gains in income and opportunity. When you look at the 1982 list, you are

looking at dynasts who made it through the leveling period plus that subgroup

that benefited ‘meritocratically’ from oil, building, manufacturing, and real

estate. In the years since, the list reflects the baby boomer years – year in

which, among other things, higher education was relatively cheap and available

for the ambitious. We have now reached the period when that group is going into

its sixties, and the wealth is definitely settling into place. Along with the

perrenial dynasts, there are the long timers – people who have been on the list 15 years or

more – who need to be broken out.

D.

As well, it is unclear from Kaplan and Rauh’s

charts if they double count these perennials. If Bezos is counted, each time,

as coming from the wage class in their compilation – rather than once, when he

entered the list – they are making an elementary error. I suspect they make it.

I suspect they know that they are making it. I suspect that they are working

for the American Enterprise institute.

E.

However, the larger criticism concerning how

well the 400 represents dynastic wealth. In fact, the very framework seems to

occlude it. In 1987, CBS news reported that, curiously, there was not a Dupont

on the list, even though the Dupont family was worth an estimated 10 billion

dollars. CBS resolved this anomoly by pointing out that if each of the 1500

Dupont relatives got a share of that money it would come to 5 million apiece.

However, this is a deeply misleading. The Dupont fortune operates as a unified

entity through family trusts. As an entity, it is as unified as the ‘Gates’

entity. In a list of individuals going from 1982, sheer mortality and

reproduction would naturally diminish the part of the inheritors, but this

would not really give us an idea of how much money is under dynastic control.

In 1937, a journalist named Lundberg published a book about America’s wealthy

dynasties, and the names in it seem foreign to us, who are used to reading

about tech barons and hedgefunders. But those families rarely lose their money.

The Pitcairns, for instance, who started PPG, have a private family investment

fund in which all the family participates. Individually, they would not be on

the list, but as an entity, it is a good bet they would be. The same is true

for the Weyhaeusers. There are many many families like this.

Forbes recognizes this in other lists – for instance,

they simply amalgamate all the Walton wealth into Walton Family on their world

billionaires list. But they are very inconsistent about it in the 400 lists.

Sometimes children and spouses appear separately, sometimes they don’t.

For all these reasons, Kaplan and Rauh’s 400 proof is a

farce. A farce that, I should say, is easily seen through. One doesn’t have to

go through some complicated mathematical proof, one simply has to apply

elementary social science reasoning. It is the kind of thing that is dogfood

for the dogs, rightwing columnists who can wave the paper about and claim to

have refuted the socialists and Stalinists once and for all. Only mooks would

fall for it.

This is, of course, why it gets an honored place in LarrySummers’ review of Thomas Piketty’s Capital. Summers, Obama’s favorite economist, the man who design the Clinton era

deregulatory architecture – or should I say, instead, wrecked regulation of the financial markets

and helped midwife the depression? -

inserts the following paragraph in gesturing towards other evidence that

American wealth is not becoming so unequal:

“A brief look at the Forbes 400

list also provides only limited support for Piketty’s ideas that fortunes are

patiently accumulated through reinvestment. When Forbes compared

its list of the wealthiest Americans in 1982 and 2012, it found that less than

one tenth of the 1982 list was still on the list in 2012, despite the fact that

a significant majority of members of the 1982 list would have qualified for the

2012 list if they had accumulated wealth at a real rate of even 4 percent a

year. They did not, given pressures to spend, donate, or misinvest their

wealth. In a similar vein, the data also indicate, contra Piketty, that the

share of the Forbes 400

who inherited their wealth is in sharp decline.”

A brief look here can be

defined as the look one gives the index card on which one has copied some “happy

facts” to share with the assembled plutocrats at one of Summers $50,000 talks. It is the index card that has the orange

sauce from the duck on the corner.

I am not shocked that

Summers would publish something this stupid. It is not that Summers is a stupid

man – he is, mainly, an “insider” – someone who knows how to “play” in DC, as

he famously told Elisabeth Warren. In

the economics profession, Summers is widely regarded as a genius. This says

less about the elevation of his intellect than the shallowness of his field – a

molehill is an Everest to a herd of aphids.

Like the overwhelming

majority of economists, Summers isn’t very good in thinking in broad terms, or

understanding the economy and what it is for. He is perpetually like a man

standing with his nose three inches from a pointillist painting – he can see

all the dots in detail, but he can’t see or imagine the picture. This is

fortunate for him – economics is the handmaiden of the plutocrats, and those

who step back and begin to see the picture are soon quietly sidelined.

No comments:

Post a Comment